On 12 August 2025, the Malaysian ringgit continued to strengthen against the US dollar. This came just hours before the release of the US Consumer Price Index (CPI) — a major inflation report that global investors are watching closely.

Contents

Why is this happening today?

Traders around the world are adjusting their positions in anticipation of the US inflation numbers. If the CPI shows that prices in the US are rising more slowly, it could mean the US Federal Reserve won’t raise interest rates again soon. Lower US interest rates typically weaken the US dollar, making the ringgit stronger in comparison.

How this affects Malaysians right now

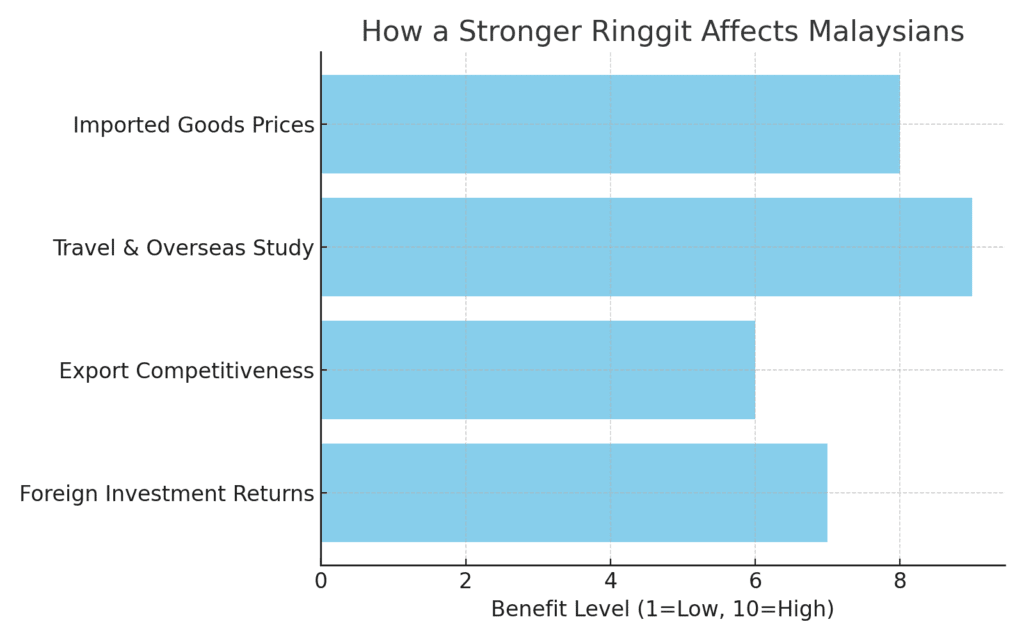

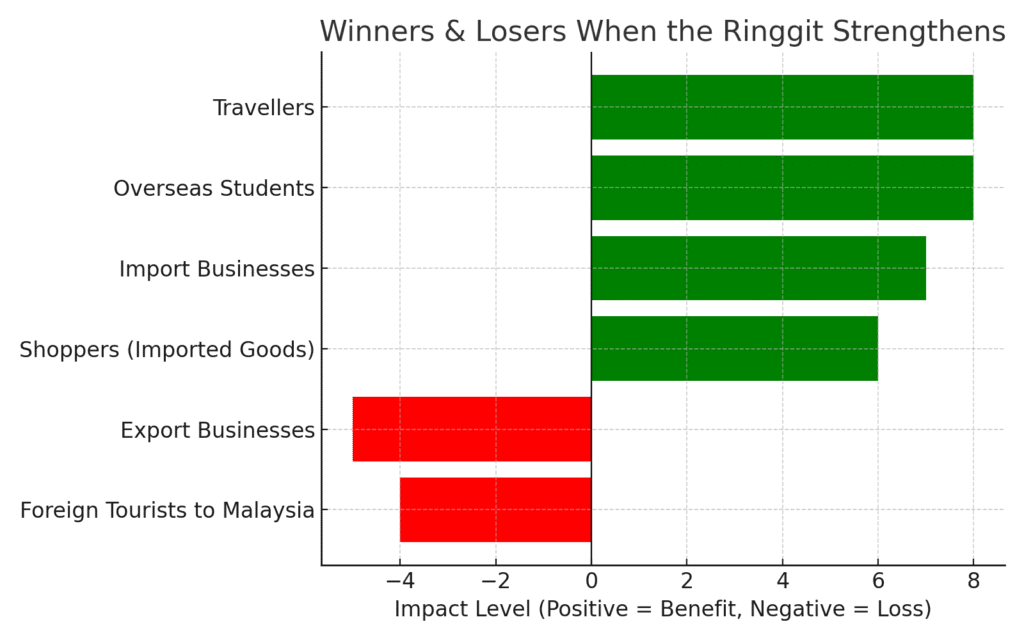

| Group | Impact |

|---|---|

| Shoppers & Families | Imported goods like electronics, petrol, and some food items could become slightly cheaper. |

| Travellers & Students Abroad | Today’s stronger ringgit means you get more USD for every MYR exchanged — lowering travel and tuition costs. |

| Import Businesses | Overseas purchases (raw materials, machinery) cost less in MYR terms. |

| Export Businesses | Slightly less competitive pricing overseas, but cheaper to buy imported components. |

| Investors | Investments abroad may yield more MYR when profits are brought home. |

Visual: Who Benefits the Most from Today’s Stronger Ringgit

Visual 2: Winners & Losers When the Ringgit Strengthens

A simple way to think about it

Imagine going to a US online store. Yesterday, RM1 might have bought you less than it does today. Now, that same RM1 stretches further — you’re getting a better deal for the same money.

Quick reminder

Today’s gain is positive news, but currency values can change quickly. Factors like oil prices, global trade tensions, and economic policies — both in Malaysia and the US — will continue to affect the ringgit in the coming weeks.